Is there a Fed Pivot on the corner?

Federal Reserve pivot, or fed pivot for short, is when the Federal Reserve reverses its monetary policy stance. In this case, a Fed pivot would mean a decrease in the interest rates.

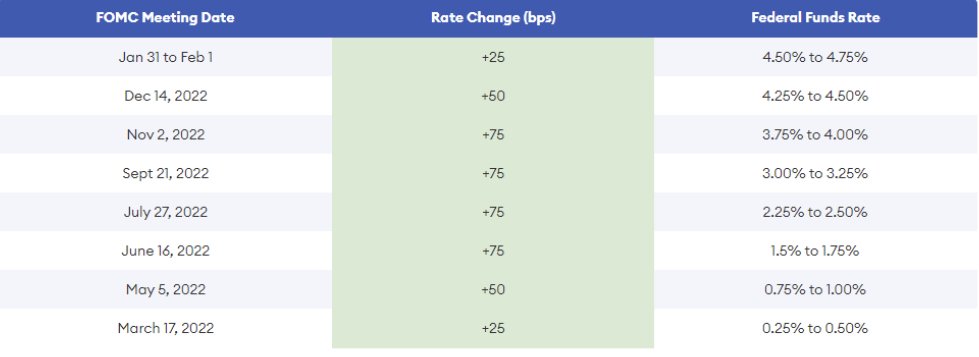

As a result of an FOMC meeting, its members have decided to raise the target range for the federal funds rate to 4.5 to 4.75%, or an increase of 0.25%. Due to that, some analysts expect the Fed pivot could be as soon as the 2nd quarter of 2023, with markets betting that a U.S. economic slowdown will force the bank into reversing its hawkish stance this year. We can also see on the chart below that the Fed is starting to decrease the rate of interest rate increases.

Source: Forbes.com

Effect of interest rates on the stock market:

Before the main argument, let's discuss why the fed pivot is essential and how it will affect the stock market. We also need to mention that the correlation between interest rates and the stock market is not straightforward; however, generally, it is an inverse relationship.

For example, if we look at the graph below, we can spot the relationship between interest rates and stock market change (In this case, it's measured through the S&P 500 index price change).

Source:MacroMicro

Also to be mentioned is that when interest rates are high, it's expensive to borrow money for the companies representing slower or negative growth rates which may translate to a decrease in their stock price. Also, interest rates impact the sentiment of the people as an increase in them, as said above, may cause slower or negative growth rates for companies and hence may cause people to sell their stock positions and vice versa when interest rates decrease, making borrowing more cheaper.

With the CPI for January coming in at an increase of 0.5% and PPI for final demand advancing 0.7%, way past expectations, we can assume that we are nowhere near a fed pivot since the inflation is pretty strong, and we haven't reached the target inflation of 2%. On the other hand, some analysts say that price changes often lag by 8-12 months and that if we keep raising interest rates, we could potentially set them too high and crash the markets. However, we can argue that even after 12 months, the inflation is still constantly rising, with, for example, shelter prices constantly rising by an average of 0.7% for the past four months with no sign of slowing down.

With all that being said, we can confidently say that the fed pivot won't be soon and may take some time and results of measures to decrease inflation; however, due to inflation still being strong in the sectors that have a high weight in the consumer basket, we can say that the fed pivot won't be soon.

Written by Timur Ibragimov | Proofread by Yasmin Uzykanova