From Inflation to Greedflation

Introduction

In the intricate landscape of Economics, the term “inflation” has been a long topic of discussion. However, after the COVID-19 crisis and the Ukraine war, a new concept has emerged to describe a more complex phenomenon named “Greedflation.”

Before it, many other economic crises have also taken place, like stagflation, disinflation, Volker Shock, Global Financial Crisis, etc.

However, Greedflation is in the news nowadays. “There is a growing consensus worldwide that corporate greed is causing inflation, and workers are being doubly penalized by low wage rate increases and higher interest rates.” Greedflation is coined of two terms- greed + inflation.

And it is an extreme form of inflation. It occurs when the business raises prices to gain profit during the crisis and exploit the situation.

Is it happening in the world?

In 2021, German Economist and UMass Amherst Economics professor Isabella M.Weber, in an article for “The Guardian, argued that “sellers inflation,” the same term as “greedflation” driven by companies exploiting supply shocks and disruptions to raise the price, is a significant factor in price rise.”

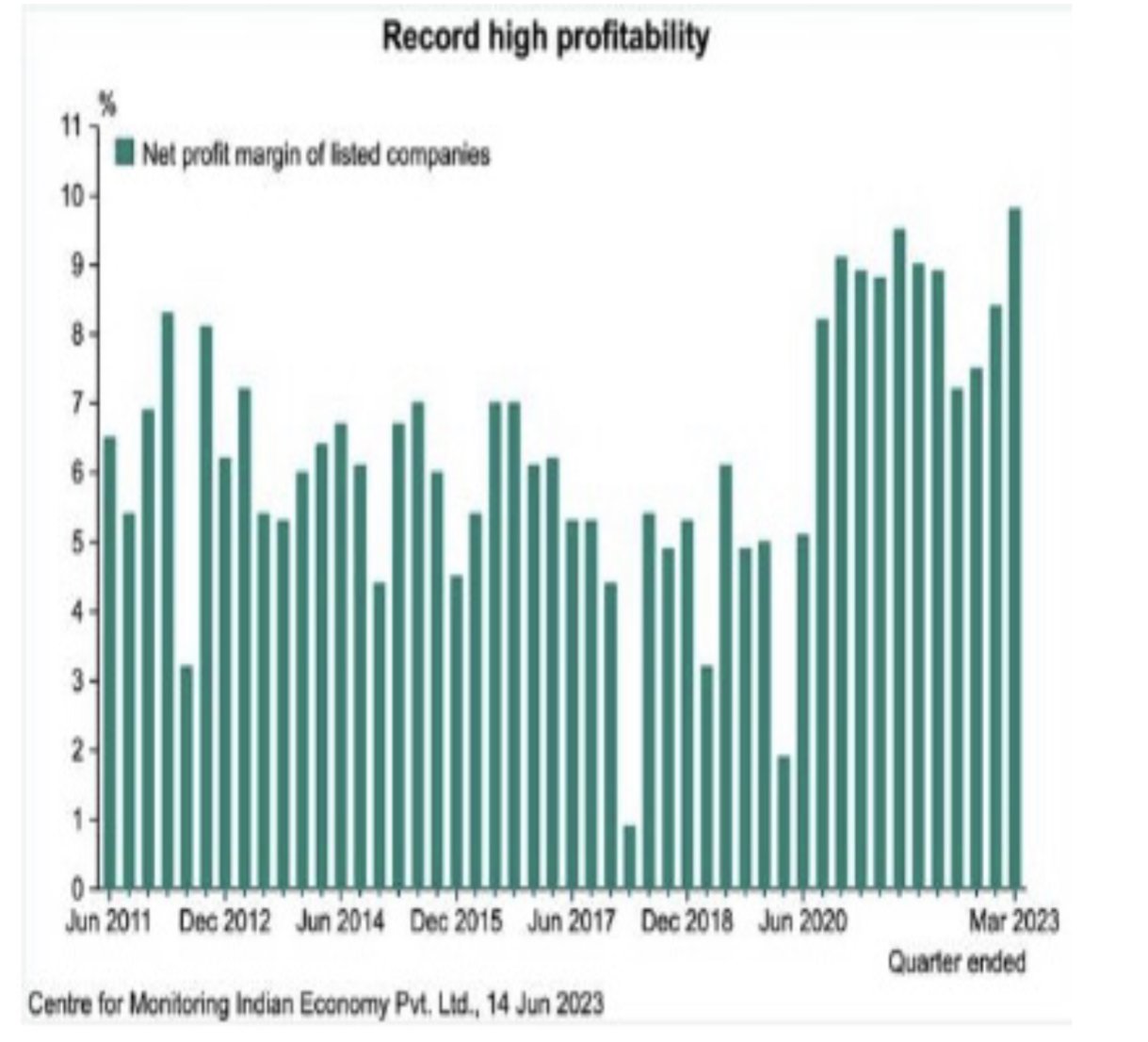

In an article published by Business Insider, “Most consumers think food brands are using inflation as an excuse to hike prices, survey says.” Not long ago, the debates were also there in India regarding the hikes in the price of tomatoes – whether it was the weather conditions or “greedflation”? According to the chart by the Centre for Monitoring Indian Economy (CMIE), There is an increase in the profit margins of corporates in the post-pandemic period.

That denotes that the corporate sector, too, played a significant role in inflation. The increase in sales by 36% contributed to the growth of profit margins, suggesting greedflation. Studies in the US, the UK, and Australia found that excess corporate profit drove 54%, 59%, and 60% of inflation, respectively. These margin increases suggest that companies are taking advantage to boost their profit, which explains the impact of greedflation.

Source: The Indian Express

Impact of greedflation

“I fear the “super normal profit Margins” of corporations in the U.S. and abroad could eventually “inflame social unrest” if consumers continue to struggle with inflation.”, said Albert Edward, a global strategist.

Greedflation can have negative consequences on the economy, for example, Reduction in the purchasing power of consumers, unequal distribution of wealth, and negative impact on investments. Greedflation can even increase people’s anxiety as it increases their cost of living and obstructs them from purchasing necessary goods. However, some economists also claimed t“A bit of corporate greed may be helping the fight against the recession, and it may be the end of capitalism.”

Counter Arguments:-

The term “Greedflation” has not been widely accepted by Economists. The ones who disagree with it argue, “ The companies can’t set prices arbitrarily, and the prices are set according to the purchasing power of the consumers.” One of the articles published by “The Economist” stated that Greedflation is nonsense and another form of inflation driven by fast-growing wages.

Regulatory Measures

Some incentives can be implemented to control Greedflation:

A) Price controls- Temporary Price controls on essential commodities could be enforced to stabilize prices and prevent hoarding.

B) Consumer Protection- Strengthening the laws for consumer protection will prevent unethical business practices that contribute to Greedflation.

C) Public Awareness Campaign- Educating the Public about the risks of speculative investments and price manipulation would also help curb Greedflation.

Conclusion

The phenomenon of Greedflation is a matter of debate among economists. It presents a pressing challenge that requires a balanced and comprehensive approach. By implementing regulatory measures to address excessive speculation, price manipulation, and unsustainable growth, policymakers can strive to create a more stable and equitable economic environment. While achieving this goal may be complex, the potential benefits of mitigating greedflation's negative impacts on markets and society make the endeavor worth pursuing.

Written by Aastha Shukla | Proofread by Yasmin Uzykanova