The Increase of Medicines’ Price Ceiling

The NPPA (National Pharmaceuticals Pricing Authority) approved the, one time, 50% increase in the price ceiling of nine scheduled formations of three drugs (carbamazepine, ranitidine, and ibuprofen) on June 28th. This was to stop the possibility of the drugs becoming unavailable in the market and consumers being forced to move to more expensive alternatives.

What are price ceilings?

Price ceilings are the mandated maximum amount a seller is allowed to charge, which is below the market price, set by law generally in order to ensure certain goods don’t become unaffordable for some customers due to the price mechanism.

However, price ceilings have their drawbacks. They may increase affordability in the short run but create a shortage in the long run. This is because market forces do not meet in equilibrium when a price ceiling is imposed below the market price.

As seen above, a shortage of quantity is created by Qd-Qs, when re quantity demanded is greater than the quantity supplied. This can cause several negative and positive outcomes in the short and long run.

How is increasing the price ceiling resulting in higher stock prices?

The need for the increase in the price ceiling is to incentivise supply through higher profits, as demand is already there and high - but supply does not meet it (hence, the shortage). Therefore, once supply increases at a higher price demand will not fall (due to the inelasticity of vital drugs) and revenue will increase, potentially by over 50%. Therefore, dividend payments of drug suppliers will increase and more people will want to buy into the growing industry, causing higher stock prices.

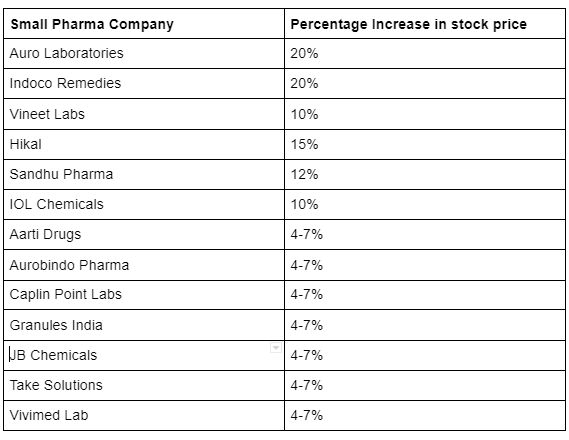

Here is a table illustrating all the small pharma companies benefiting from the increase in price ceiling.

Effect of increasing the price ceiling on all stakeholders in the small pharma market

When a price ceiling is increased it is brought closer to the market price, 4 stakeholders are affected - producers (firms), consumers, government and workers (in the firms).

Producers, as mentioned above, benefit greater from a price ceiling increase. Their revenues increase because of rising prices and quantity traded. Even though they are not selling at market price (which would be ideal for the producers), they are in a much better position as reflected by their stock prices.

Consumers may have 2 reactions. The section of consumers (as shown in the graph above) to whom the drugs were available will be unhappy due to higher prices, however, the section of consumers to whom the drug was unavailable, due to the price ceiling being further below the market price, will be happy because of increased availability. Even though the price ceiling is not at market price, where the medical drugs are available for all consumers, increasing the price ceiling can increase availability by a lot.

The government of India may gain popularity by small pharma companies and consumers who are now benefited by increased availability. However, this is very subjective and not qualitatively measurable at the moment, it is still something to be considered by the government, before and after making such decisions.

Workers in the small pharma industry will definitely benefit due to the companies receiving higher revenues. This can mean increased salaries, employee benefits and an overall boost in the company morale.

Conclusion

Price ceilings are a very common price control implemented by governments all around the world to increase affordability. However, the drawbacks must be taken into account prior to implementation. In the case of the small pharma industry, their main aim is to provide drugs at lower prices than the pharma giants, therefore, price ceilings are very common. Although, the extent of the price ceiling needs to be regulated to allow for availability, affordability and growth of the small pharma industry.

Written by Aryan Jain and Elin Thomas; edited by Alexey Dudarev